What is it?

The Credit Arbitrage Algorithmic Trading System (CAATS) is an ongoing project to develop an algorithmic trading system specifically for credit or capital structure arbitrage.

CAATS identifies new relative value trading opportunities arising from misaligned pricing of risk across traded equity and credit derivative markets. It also risk-manages ongoing exposures, while generating overall market-neutral investment strategies.

The CAATS learning algorithm is the product of combining proprietary quantitative analytics from Seven Streets’ C2E platform with cutting edge data science technology.

Immediate applications of the CAATS learning algorithm include credit and equity derivatives, stocks, hybrid securities and convertible bonds. With time, Seven Street will explore applications of the same algorithmic architecture to a wider set of products and asset classes.

CAATS trading strategies will be of particular interest to alternative asset managers, specifically those with relative value or capital structure based mandates.

Background

The CAATS Project has its origins in the experiences of its founder, gained as a researcher and trader of capital structure strategies for several years at one of the world’s top credit hedge funds.

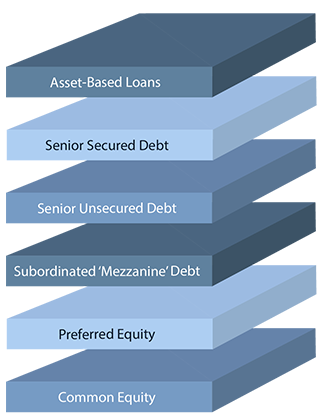

Capital structure arbitrage is the practice of holding offsetting positions in a firm’s traded equity and credit securities with the aim of profiting from valuation discrepancies. It is an example of a trading strategy that makes good intuitive sense but, in practice, often proves very challenging to succeed at consistently over time.

This strategy is, therefore, regarded with much caution and so, as a result, comprises a relatively niche investment space. However, this also means that much value goes unclaimed, presenting an excellent opportunity for anybody capable of identifying and capturing it.

This challenge, and the opportunity it gives rise to, was the motivator behind the CAATS Project.

The solution

CAATS applies two technologies to directly address key the problems experienced by practitioners in this space:

- The C2E risk and valuation engine: A proprietary quantitative analytics platform that facilitates direct risk comparisons across the capital structure. C2E provides relative value metrics that may be tracked over time against equity and credit market prices and also enable effective risk management through calculation of accurate cross-asset hedges.

- The proprietary CAATS learning algorithm: applies data science techniques to capture the complex interplay between various risk metrics and market prices; then generates market price predictions, which are adapted to historic experience. These predictions are the basis for entering new trades and risk-managing existing exposures.

The AlgorithM

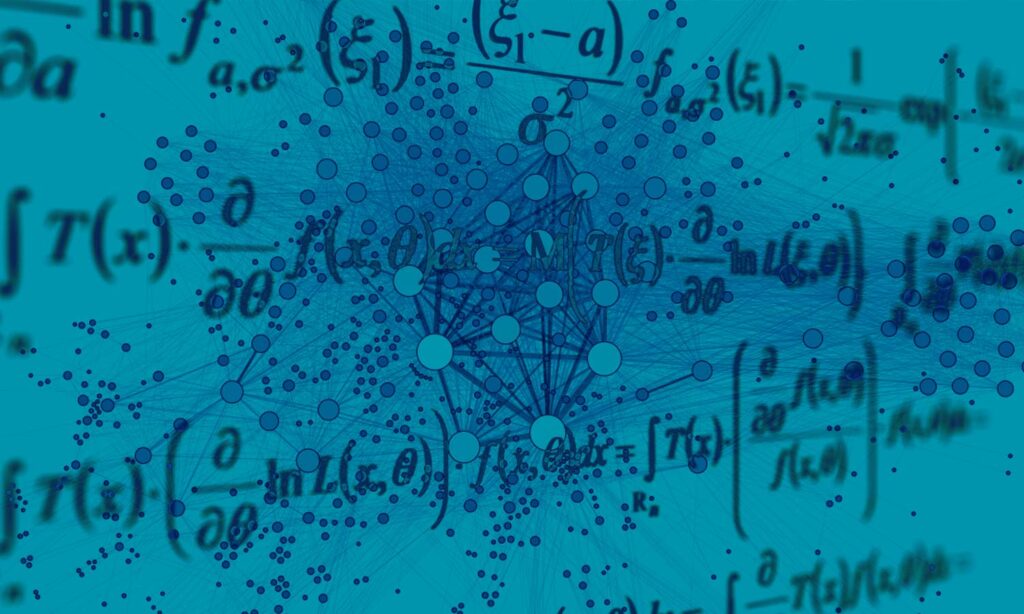

Building on risk metrics generated by C2E, CAATS implements a neural-network based, unsupervised deep learning algorithm to identify and recommend trading opportunities with the highest degree of confidence for success.

To test the efficacy of the algorithm, these trading recommendations have been extensively back-tested using historical market prices.

The firms in the sample were chosen specifically to test the ability of the algorithm to handle credit events, such as default, and large swings in credit quality. The back-testing shows that the first generation of CAATS algorithm performs favorably compared to its peer benchmark and these results can be found here.

A key factor in the success of CAATS is accurate historic market data as the foundation on which to build its analysis framework. This is why Seven Street uses S&P Global (formerly IHS Markit) as its’ primary data partner.

Where this is all going

Seven Street will seek partnerships for implementing trading strategies powered by the CAATS algorithm. A partner will:

- Gain exposure to a potentially lucrative yet relatively lightly contested investment space without the need to develop the extensive cross-market technical expertise necessary to generate an in-house strategy.

- Gain an edge over competitors with our unique, proprietary platform and realise attractive, market neutral returns, trading entities across all industries and credit grades.

- Have the option to implement separate long-short strategies in equity or credit, depending on access to market, and apply as either a stand-alone algorithmic strategy or as a complement to a fundamentals based strategy.

To learn more about the CAATS Project, please feel free to get in touch here.