C2E is Seven Street’s proprietary risk and valuation engine created specifically for investors trading across the capital structure; that is, those taking risk positions in debt and equity-based securities that are traded across separate markets but that relate to the same entity.

However, managing risk across equity and credit markets is always challenging because relationships between observable prices – like tips of an iceberg – only tell a small part of the risk story linking the two markets.

C2E addresses this challenge by providing an internally consistent risk analysis framework for factors driving value across both markets.

C2E has applications spanning risk and valuation and, of course, as a powerful analysis tool for those seeking to identify and capture value across the capital structure.

Risk and Valuation

C2E incorporates prices from across the traded capital structure to create an internally consistent risk framework through which the relative value of securities from different parts of the capital structure can be evaluated.

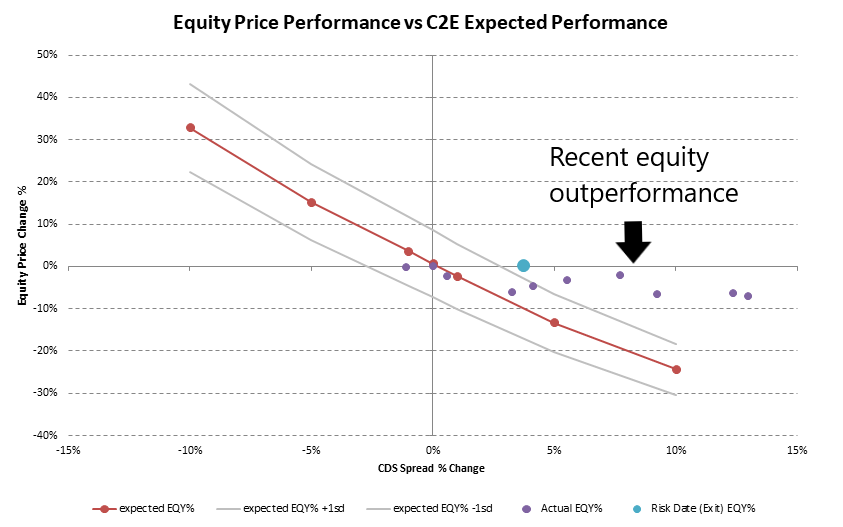

For example, the chart below shows how, using C2E, the risk premium implied in the prices of equity securities can be compared directly to that of credit securities, in this case the credit default swap (CDS) spread.

Importantly, C2E creates a risk framework through which the relative sensitivity of security prices across capital markets can be measured. This allows, for example, hedging ‘deltas’ to be calculated so that a credit product can be hedged with a risk-equivalent amount of equity product.

The chart above shows ‘deltas’ (number of securities) calculated by C2E required for hedging a $10m notional CDS contract with vanilla equity option contracts across a range of strikes or just straight equity shares. The more in-the-money the options become, the more the deltas converge with straight equity.

Above we see how C2E can be utilized to value hybrid securities with both debt and equity characteristics. Over the entire life of this convertible bond, C2E accurately evaluates the convertible premium implied in its quoted price.

Trading the Capital Structure

This insight into risk, value and relative sensitivity provides us with a powerful way to evaluate relative movements of prices across the capital structure. This allows us to form views on the potential for a trading opportunity (and how profitable it might be). For example, in the chart below, C2E implies an increased likelihood that this firm’s equity will sell off significantly in the near future given its recent price moves in relation to credit spreads.